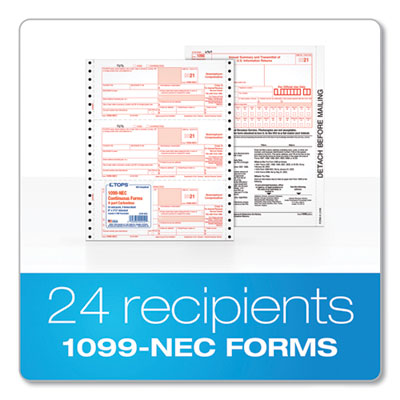

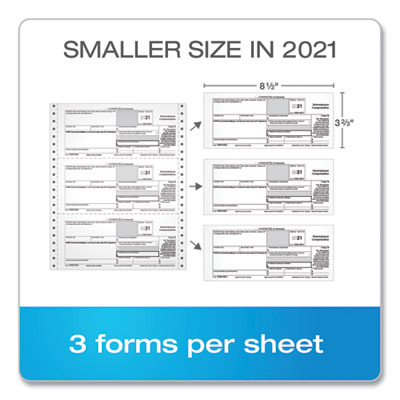

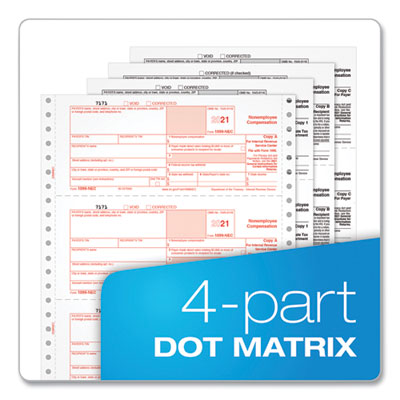

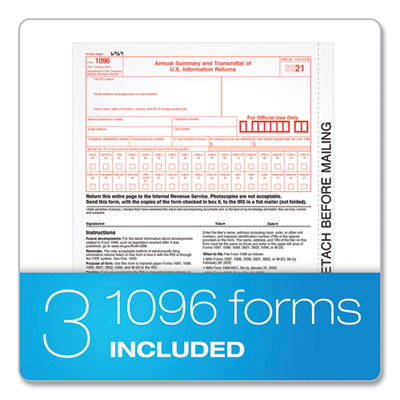

TOPS™ 1099-NEC Tax Forms report nonemployee compensation paid to your independent contractors. This year, the IRS has reduced the size of the NEC to fit 3 forms per sheet. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Copy A and 1096 sheets have the scannable red ink required by the IRS for paper filing. Form Type Details: 1099-NEC; Dated/Undated: Undated; Forms Per Page: 2; Forms Per Page Layout: Vertical: Two Down.

TOP2299NEC

TOP-2299NEC