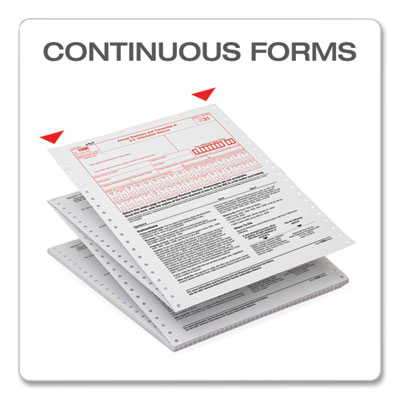

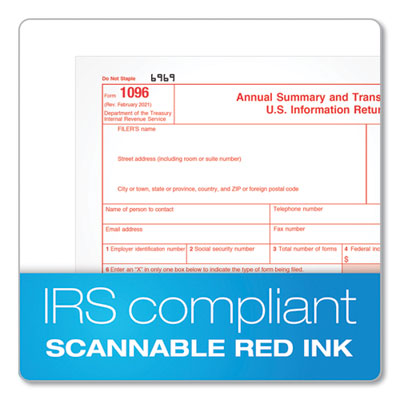

TOPS™ 1096 Summary Forms transmit the totals for select information returns to the IRS. You’ll use the 1096 to summarize your 1097, 1098, 1099, 3921, 3922, 5498 and W-2G forms. You’ll need a separate 1096 for each type of form you file. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Dot Matrix Printer Compatible. Form Type Details: 1096; Dated/Undated: Dated; Fiscal Year: 2022; Forms Per Page: 1.

TOP2202

TOP-2202